ICR Economics’ quantitative analysis of the Turkish Merger Control Regime and Phase II reviews.

On the occasion of the 25th anniversary of the appointment of the first members of the Turkish Competition Board, we have made a quantitative analysis of the elements that we find interesting in the investigation decisions of the Board. In this second part of our tribute, we have analysed the findings of the Board regarding mergers, acquisitions, and joint ventures (“mergers”), i.e. the Turkish Merger control regime.

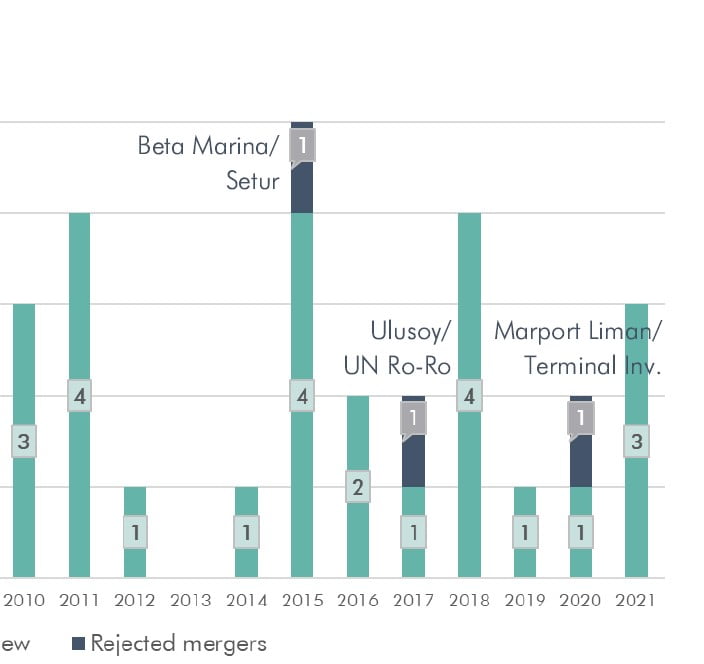

As seen in the following pages, since most merger control decisions result in authorisation, they are not worth analysing in terms of competition policy, except for their sheer number. Therefore, our study focused on more severe mergers, i.e., the transactions subject to Phase II review under Article 10(1) of the Competition Law due to competitive concerns.

With the amendment made by Communiqué No. 2022/2 dated 4 March 2022, the turnover thresholds used to determine the necessity of notification of mergers to the Turkish Competition Authority (“TCA”) were raised, and a necessary step was taken for the Competition Authority to focus more on mergers that may raise competitive concerns. Therefore, it will not be surprising to see fewer merger decisions in the coming period, but with greater importance in terms of competition policy.

The Turkish version of this report on the Turkish Merger Control regime can be found here.